Financial Mathematics

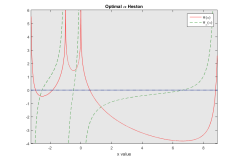

Having 20 years of experience in financial institutions (Specialist and Team Head level), software vendor business (Product Management and Consultant) and consulting (Director and Partner level) we are involved in many areas of financial mathematics either from a practical as well as from an academic perspective. This includes derivatives pricing and hedging, valuation adjustments, economic scenario generation, modelling of markets, regulatory issues and many more. We solved practical problems for banks and insurance companies as well are engaged into teaching students and practitioners. Furthermore, we do research in collaboration with leading academics in this field.

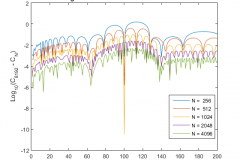

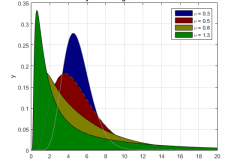

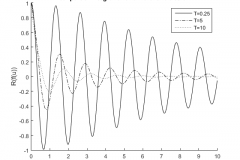

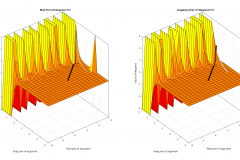

As programming tools we mainly use VBA, Matlab, C++, Python or Java to transform models into working applications that are then applied to real life tasks or build the numerical evidence for our research ideas.

To get an overview of the stuff please consult the Projects / Experience part of this website, the Papers and Books part or contact us using joerg.kienitz[at]fincirator[dot]de

Machine Learning

The application of finding patterns in data and using computers to mimic learning by using techniques such as deep learning or reinforcement learning are more than a trend.

What is subsumed under the term Machine Learning uses basic and advanced methodology from (Multi-) Linear Algebra, Probability, Optimization or Statistics to combine theses using modern computers. Programming languages which play the most important role here are Python, R or Matlab and built upon open source tools as Tensorflow, Keras, SciKit learn and libraries that allow for handling data files such as the Pandas library.

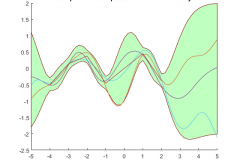

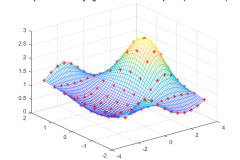

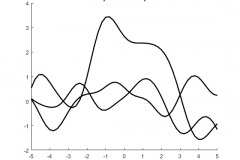

We investigate the use of such methods to be applied to problems arising in finance. Currently we investigate the application to pricing and calibration applications and to infer CDS spreads for illiquid underlyings.

Very promising seems to created modern lookup tables for speeding up computations of otherwise complex calculations e.g. expectations for high dimensional models or high dimensional cumulative probability distributions.